Algo Trading Strategist

Aim to provide the most extensive algo trading strategies

Strategies that determine your success with Automatic Trading

Algofintech - Who We Are?

In today’s scenario, Algo Trading is the future of intraday trading. This trading approach is much safer than manual trading since it is free from emotions and fear and greed and backed by technical logic. Your emotions may lead you to make wrong decisions and lead you to lose your capital. It is more focused on capturing the market moves that are more efficient and give higher risk-adjusted returns from markets.

In ALGO FINTECH.IN, our main aim is to provide a passive income from Stock Market and help people to optimize their ROI on their dead stock portfolio with the help of Algo-trading. We also provide a one-stop solution to those traders who cannot find a proper strategy that can give them consistent returns over a longer period.

We have a well-balanced portfolio of our intraday and positional strategies based on FNO, MCX and Equity Segment. All these strategies are highly risk-managed with a lower Sharpe Ratio. A low Fixed cost setup for small traders is based on a no PROFIT-SHARING MODEL. Therefore, our purpose is to help those traders who can trade manually in the market due to their day-to-day work and other obligations like their jobs & Businesses.

Abhishek Kalla holds a degree in engineering with a Master’s in Business Administration (MBA). He has acquired deep financial acumen working with several renowned financial institutions like BSE, Sharekhan, etc. His quest for technical know-how, relevant qualifications and varied experience in this domain inspired him to design strategies for Algo Trading.

Further, his commendable knowledge in financial modelling, equity research, options, derivatives, futures, fundamental financial analysis, technical financial analysis and the overall functioning of trade markets in India have induced him with the skills to strive for par excellence in delivering trading solutions best suited for all traders and investors.

Why Choose AlgoFintech?

Accurate and Error Free

No Emotions

Works 24X7

Ability to Back Test

Ease Complex Calculations

Multiple Strategies

Algotrading Methodologies

TREND AND MOMENTUM

This is the most common and simple algo trading strategy to adopt. The trades are executed following the momentum and trends of the market. The algorithm is set in the system comparing past and present prices.

MEAN REVERSION

The algorithm is set to define the mean price of an asset with an expectation that the value of an asset will go down when high and vice versa. The trade is executed when the share breaks in and out of its defined price range. Thus, preventing extreme price swings.

STATISTICAL ARBITRAGE

This is a short-term strategy that seeks to profit from the narrowing of a gap in the trading prices of two or more securities. It constitutes a complex mathematical model that tracks the changes at the last minute and closes the deal, which is difficult for humans to track.

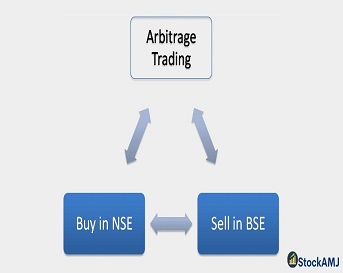

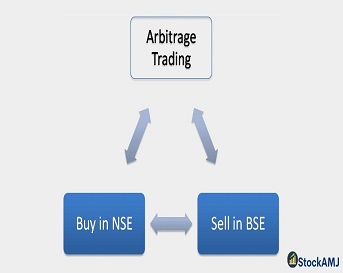

ARBITRAGE TRADING

In this trading, simultaneously buy and sell an asset in different markets to take advantage of a price difference and generate a profit. The algorithmic set works with unmatchable speed and accuracy compared to humans.

WEIGHTED AVERAGE PRICE

This is the best algo strategy based on either volume or time or price. Small lots of large volumes are released based on the average price of a stock over a period of time. Thus, protecting from the impact of the volatile market that a manual process lacks.

SCALPING TRADING

It is a trading strategy that aims for profit from minor price changes in a stock’s price. Traders believe that small moves in stock price are easily to catch as comparted to large ones. Many small profits can easily sum up to large gains if we exit at right time to prevent large losses.